Catamaran Business Ownership

Catamaran Guru has been at the forefront of developing and operating the “Yacht As A Business”, or for us, “Catamaran As A Business” concept. We have not only advocated it to our clients, but have personally benefitted from this program. We found that most yacht owners use this program as an avenue to acquire the cruising catamaran of their dreams for retirement at a huge discount. Others, like ourselves, use the yacht charter revenue together with the business tax deductions to reduce the costs of owning a very nice yacht that we enjoy now.

The goal is to structure your yacht business in such a way that you have the intent and ability to make a profit! What you CANNOT do, is structure this business with a flawed business plan of "limited charter" and purposely run it at a loss to avoid wear and tear on your boat while offsetting the cost of ownership with business tax deductions. You CANNOT "pretend" to be in business! However this program, when done correctly, offers the least expensive alternative to own a boat!

What Is A Yacht or Boat Business?

A yacht or boat business is a fairly simple concept and is structured much like any other for profit business. By placing a yacht into a corporation (usually an LLC) and operating it actively for profit, either directly or through a third party management company, the owner is able to generate substantial tax advantages that further offset the cost of ownership. For U.S. buyers who are in high income tax brackets, this is definitely an option of ownership that should be explored.

The tax benefits must be carefully planned and documented to make sure that the business activity can withstand scrutiny. There are very specific rules and requirements that need to be complied with in order to meet the standard of actively operating a business for profit and taking tax advantages.

Why Consider Purchasing a Boat Through Your Business?

Buying a boat through a business entity offers more than just a luxury—it’s a financial strategy that many small business owners leverage to maximize returns. Here’s why buying a boat through your business could be a smart move:

- Tax Benefits – Deduct significant expenses such as depreciation, maintenance, fuel, and more. See explanation & examples of Section 179 & Bonus Depreciation below

- Asset Protection – Minimize personal risk by owning the boat through an LLC. See “how to set up a yacht business” below

- Revenue Potential – Offset expenses by chartering income

By structuring your boat purchase under your business, you can turn what would be a personal expense into a smart financial investment.

Tax Benefits of Purchasing a Boat Through Your Business

Owning a boat through your business comes with significant tax advantages, allowing you to reduce taxable income by taking advantage of IRS-approved deductions.

- Depreciation Deductions: Business owners can depreciate the cost of their boat over several years, lowering their taxable income. Exceptions apply i.e. 100% bonus depreciation (read more below)

-

Expense Deductions: When the boat serves legitimate business purposes, various expenses can be deducted, including:

- Maintenance & Repairs

- Fuel & Operating Expenses

- Crew Wages & Insurance

- Loan Interest Costs

*To ensure you qualify for these deductions, it’s crucial to maintain detailed business records that demonstrate the boat’s use for business activities, as required by the IRS for active LLCs.

What Is Section 179 Business Tax Deduction?

People seem to think that the Section 179 deduction is some complicated tax code, but really it is not. Essentially, Section 179 of the IRS tax code allows businesses to deduct operating expenses and depreciate the qualifying equipment purchased or financed during the tax year. Typically, when a business buys new equipment, the purchase price can be depreciated using the MACRS scale which is an accelerated depreciation schedule.

The original target of this legislation was much needed tax relief for small businesses – and millions of them are actually taking action and getting real benefits. So, if you are in the market for a new yacht, the Section 179 rule should definitely be a part of your yacht-buying strategy.

According to this law, when used as part of a business, you can legitimately divert some of the taxes that you’re already paying into the sailing vessel. This in turn, creates equity in your new yacht. Therefore, buying a new yacht and placing it in charter service as a business, makes total sense to reduce cost of ownership and turn tax advantages into an investment. It is vitally important the business is set up correctly and the operation is structured to qualify for the tax benefits and remain in compliance going forward.

Understanding Section 179 Business Tax Deduction

*The U.S. Congress has halted the Section 179 roller coaster of the past recent years by making the Tax Deduction limit permanent. The limit was raised to $2,500,000. This is good news for yacht businesses, as the owners and their tax advisers now know early in the year that the deduction will be there for them and they can plan accordingly.

Have Questions? Book a FREE CALL Tel: 1-804.815.5054

*This information is general in nature and purchasers are encouraged to seek experienced legal counsel in yacht acquisition planning and implementation. Catamaran Guru is not a licensed tax attorney or CPA and is not qualified to give legal advice, but we can put you in touch with experts who are.

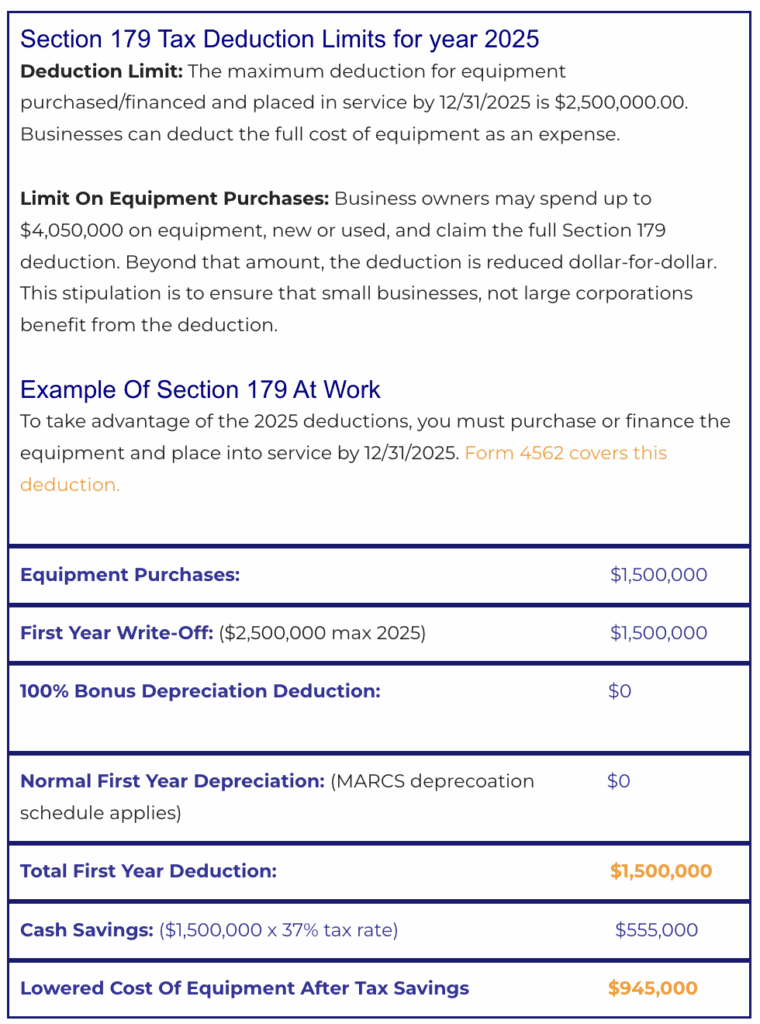

Section 179 Tax Deduction Limits for year 2025

Deduction Limit: The maximum deduction for equipment purchased/financed and placed in service by 12/31/2025 is $2,500,000.00. Businesses can deduct the full cost of equipment as an expense.

Limit On Equipment Purchases: Business owners may spend up to $4,050,000 on equipment, new or used, and claim the full Section 179 deduction. Beyond that amount, the deduction is reduced dollar-for-dollar. This stipulation is to ensure that small businesses, not large corporations benefit from the deduction.

Example Of Section 179 At Work

To take advantage of the 2025 deductions, you must purchase or finance the equipment and place into service by 12/31/2025. Form 4562 covers this deduction.

Equipment Purchases:

$1,500,000

First Year Write-Off: ($2,500,000 max 2025)

$1,500,000

100% Bonus Depreciation Deduction:

$0

Normal First Year Depreciation: (MARCS deprecoation schedule applies)

$0

Total First Year Deduction:

$1,500,000

Cash Savings: ($1,500,000 x 37% tax rate)

$555,000

Lowered Cost Of Equipment After Tax Savings

$945,000

*The above information is an overall, “simplified” view of the Section 179 Deduction. For more details on limits and qualifying equipment, please contact us directly about the variety of yacht ownership programs we can help you evaluate.

*The above information is an overall, “simplified” view of the Section 179 Deduction. For more details on limits and qualifying equipment, please contact us directly about the variety of yacht ownership programs we can help you evaluate.

Buyers Should Exercise Caution and Avoid Unreliable Sources

- Unachievable financial projections. Make sure that the numbers quoted are in fact achievable

- Big charter companies who sell boats to fill their fleets and not necessarily look after your needs as an owner. Look for quality boutique charter companies that will deliver the financials and will maintain your boat to the highest standards

- Misguided information regarding IRS requirements and the operational structure of your small business

Crewed Charter Opportunities

- Cover all the costs of ownership including the mortgage payments with income and tax advantages – the boat pays for itself!

- Enhance your lifestyle with owner use of the vessel and enjoy the pride of ownership

- All models available in this program

- Virgin Islands, Bahamas and USA locations

- “Owner Operator” option available for those who want to make a career change and be involved full time

Learn more about our Crewed Yacht Programs >> Interested? Give us a call 1-804-815-5054 or email us.

Two Yacht Owners in These Programs, Give Their Perspectives

Co-Management Business Program with

Guaranteed Income

Yacht as a Business Program

How to Set up a Boat as a Business

How to Set up a Boat as a Business

This is a very basic overview of how to set up a boat business and qualify for tax advantages. Before you make the decision to purchase a yacht, consult with us to figure out if this scenario will be suitable for your situation. There are many things to consider. We can discuss all scenarios with you and tailor the program for your personal situation.

- Figure out the size, type, and configuration of boat you plan on buying

- Decide on the destination or location you want to operate from

- Establish a business purpose – education charter, dive and adventure charters, exclusive luxury charter etc.

- Figure out what your expected revenue and expenses will be

- Create a business plan

- Create a business entity like an LLC or other pass-through entity for your business

- Plan your tax strategy. The business tax advantages should directly offset the income from your boat business activity as well as the taxable income from any other active source including your regular job (W2 income). Our business plan highlights the tax advantages available to you through the yacht as a business plan. That way you can adjust your withholding and use the tax advantages to offset cash flow immediately!

- Consider your ultimate goals and exit strategy and plan for it

- Create a marketing plan for your business – website, social media, introduce your boat to charter brokers, attend boat shows

- Charter management – It is best to team up with a management company to help manage your boat and establish a clientele if the boat is in the Caribbean or Bahamas

You can purchase your yacht to your specifications including an owner version layout, set the yacht up as a business, operate it with the help of a charter company anywhere in the world, and have your yacht at least partially or fully paid off at the end of the contract period by applying business revenues and tax advantages.

But do not be fooled. You cannot dump your yacht in a charter fleet for 5 years while collecting a guaranteed monthly income. This is deemed “passive income” and does not qualify you for the section 179 rule and tax advantages. Once your “Yacht As A Business” is set up correctly, you stand to benefit greatly from this concept, but it does require work on your part.

Work With Our Yacht Ownership Specialists

Consult with Catamaran Guru’s recognized experts in Business Yacht Ownership. Our team assists US taxpayers interested in owning a yacht at reduced costs through legitimate tax deductions. We guide you through selecting and purchasing a yacht, setting up your ‘Yacht As A Business’ to comply with IRS rules, and finding a compatible charter management company. This program allows for flexibility in yacht models, global locations, and owner usage, offering substantial cost savings and tax advantages.

What We Offer:

- Comprehensive yacht ownership program, including a 5-year projection, tax schedule, and business plan.

- Guidance on setting up your yacht charter business to comply with tax laws.

- Assistance in qualifying for tax advantages to offset ordinary income.

- Expertise in current tax laws tailored to your situation.

- Planning your exit strategy and upgrading within the program.

- Incorporating your yacht into retirement planning.

- Clarifying the difference between passive income programs and our active ‘Yacht As A Business’ approach.”

We Work With Top Catamaran Brands and First-Tier Charter Companies

- Catamaran Brands: Catamaran Guru can offer you access to some of the top brands of yachts in the world like Fountaine Pajot, Lagoon, Bali Catamarans, Xquisite Yachts, and others.

- Charter Companies: We offer the added luxury of making it possible for you to place your new yacht into service at charter bases in multiple locations around the world through affiliations with reputable charter companies like Catamaran Charters, Virgin Islands Yacht Charters, Cruise Abaco and others

Contact Us For a Consultation

There is a lot of information in these pages as we tried to make it as comprehensive as possible. But there is a lot to absorb so you may need someone to help you sort through it all. Plus there are always questions that deal specifically with your personal situation. Contact us for a comprehensive consultation. Our services come FREE if we represent you during your yacht-buying process.

BUSINESS YACHT OWNERSHIP REFERENCE MATERIALS

FAQ & Common Misconceptions About Yacht Ownership

We find that explaining what this program entails is easier for yacht owners, their accountants, and other financial advisors, if some common misconceptions and questions are addressed. This list gives a clear and uncomplicated picture of the program. Read more about yacht ownership facts and fiction.

How To Set Up A Yacht Business To Comply With Tax Laws

There are many things to consider and we give you a basic overview of how to qualify for tax advantages. Before you make the decision to purchase a yacht, consult with us to figure out if this scenario will be suitable for your situation. We will advise you on what size yacht you qualify for and what charter company will work for you in which location. We can discuss all scenarios with you and tailor the program for you and your family.

- How to set up your Yacht Business

- How To Operate A Legitimate Yacht Charter Business

- Track Your Business Activity with the Harvest App on Your Mobile

Section 179 Deduction Explained

This article explains exactly how section 179 works and how it affects boat owners. Read more about Section 179 deductions for boat businesses.

Compliance Issues For A Legitimate Yacht Charter Business

While there are many skeptics and detractors to operating a yacht as a small business, we know that if it is done correctly, with a sincere intent to create a small business, which will either be profitable in the short term or in the long term through a paid-off asset acquisition, it is the correct business strategy for a yacht owner to reduce the cost of ownership. Read more about overcoming yacht charter business compliance issues.

Charter Boat Owners Win IRS Challenges

The number one objection from CPAs is that our business yacht management program is a passive activity and will not be deemed active participation. They contend that it can be very difficult for a boat owner to prove active participation in a boat business and qualify for small business and section 179 tax deductions. However, in 2015, a couple won their case in Tax Court on passive vs. active participation. Their success validates the model that Catamaran Guru uses when advising boat buyers regarding charter boat ownership.

- Read more about the IRS case and how this charter boat owners won

- And for another court case discussing material participation in a boat business, see Kline vs IRS.

Section 179 Tax Advantages & Related Court Cases

We have seen many yacht businesses operated in charter programs very successfully around the world as small businesses by our clients. Offsetting the cost of ownership is a sound business strategy especially in the yacht charter business. However, there are many regulatory challenges to a yacht charter program, including complex tax laws, IRS regulations, active participation rules, profit motive and other business considerations.

The Court cases below illustrate the tax implications of yacht charter operations. Read about boat business tax advantages.

Boat Business Ownership Resources

- Section179.org

- Section 179 Tax Deduction Calculator

- Form 4562 covers this deduction

- Overview of Tax Relief Act Of 2010

- Full Text of Tax Relief Act Of 2010, H.R. 6467

- Checklist for Vessel Purchase

- Active vs. Passive Activity

- Section 168

- Boat as a Second Home

*This information is general in nature and purchasers are encouraged to seek experienced legal counsel in yacht acquisition planning and implementation. Catamaran Guru is not a licensed tax attorney or CPA and is not qualified to give legal advice, but we can put you in touch with experts who are.

BUSINESS YACHT OWNERSHIP SUCCESS STORIES

These are the websites of some of our owners already in the yacht business program. They have enjoyed tremendous success by following our advise and complying with the rules. We add yacht businesses like these every day and we can help you do the same!

- sailluna.com: Luna is a Lagoon 450 SporTop that operates in the Caribbean as a crewed charter yachts in the BVI.crewed yacht. Nim and Fabiola are one of our great success stories and is one of the most popular

- Sailing Location: Location is a Bali 5.4 Catamaran that operates in the Exumas, Bahamas and is arguably one of the most famous and succesful catamarans operating in the Bahamas. This is a classic story of using the business strategy and tailoring it to not only make moneya and take tax advantages, but also create a lifestyle for the owners.

- catamaranguru.com: Our own previously owned catamaran, Zuri, a Lagoon 450S, was in the program in the U.S. mostly doing instructional charters and exhibits at boat shows and demonstrations for prospective buyers.

- sailallende.com: This Fountaine Pajot Helia 44 is in Crewed Yacht charter in the BVI. This young couple is making big waves in the industry with exceptional service and have become leaders amongst their fellow crewed boat crews. Kristiann and Graham are also heads the CCCYA, the only industry representative specifically for term charter yacht owners, owner-operators and yacht owners’ representatives in the Caribbean.

- BigNauticharter.com: Big Nauti is a Bali 5.4 that operates luxury crewed charters in the BVI. It is one of the most fun boats to charter!

- Belle Vie: Belle Vie is a Bali 4.8 and broke all records in her first year of charter in 2020. Owners Greg and Christina, operates the boat as a business in crewed charter and is doing extremely well.

- Dream Caribbean Blue: Greg and Christina (owners of Belle Vie) have done so well that we have invited them to become part of this community becoming one of our boutique yacht charter management company partners. They serve a clearinghouse for many of our boats in the USVI and offer a complete and comprehensive yacht management service. They manage many of our 44ft to 54ft crewed boats in business. Check them out!

- ftmcharters.com: The Voyage 500 and her crew/owners is one of the most successful crewed boats in the BVI with numerous awards for excellence!

- irishroversailing.com: UPDATE, RETIRED. This Fountaine Pajot Lipari 41 operated between Annapolis in the summer and the Bahamas in the winter as a very successful bareboat business. They have completed their five years in the program and is now operating a sailing school out of New Jersey.

testimonials

More Charter Management Tips

Owning a Business Yacht: FAQ’s And Common Misconceptions

We have received so many questions about operating a yacht as a business in the last few months, so we’ve

Compare Ways To Own A Yacht In Charter

Compare Yacht Charter Management Programs Through our partnership with Dream Yacht Sales and other yacht management companies, we offer versatile

What Does It Really Cost to Run a Crewed Charter Yacht—And Can You Make a Profit?

Discover the real costs and income potential of charter yacht ownership. Learn how to offset expenses, maximize tax savings, and build a profitable yacht business.