Creating Sales Documents For Catamaran Sales

Creating Sales Documents For Catamaran Sales

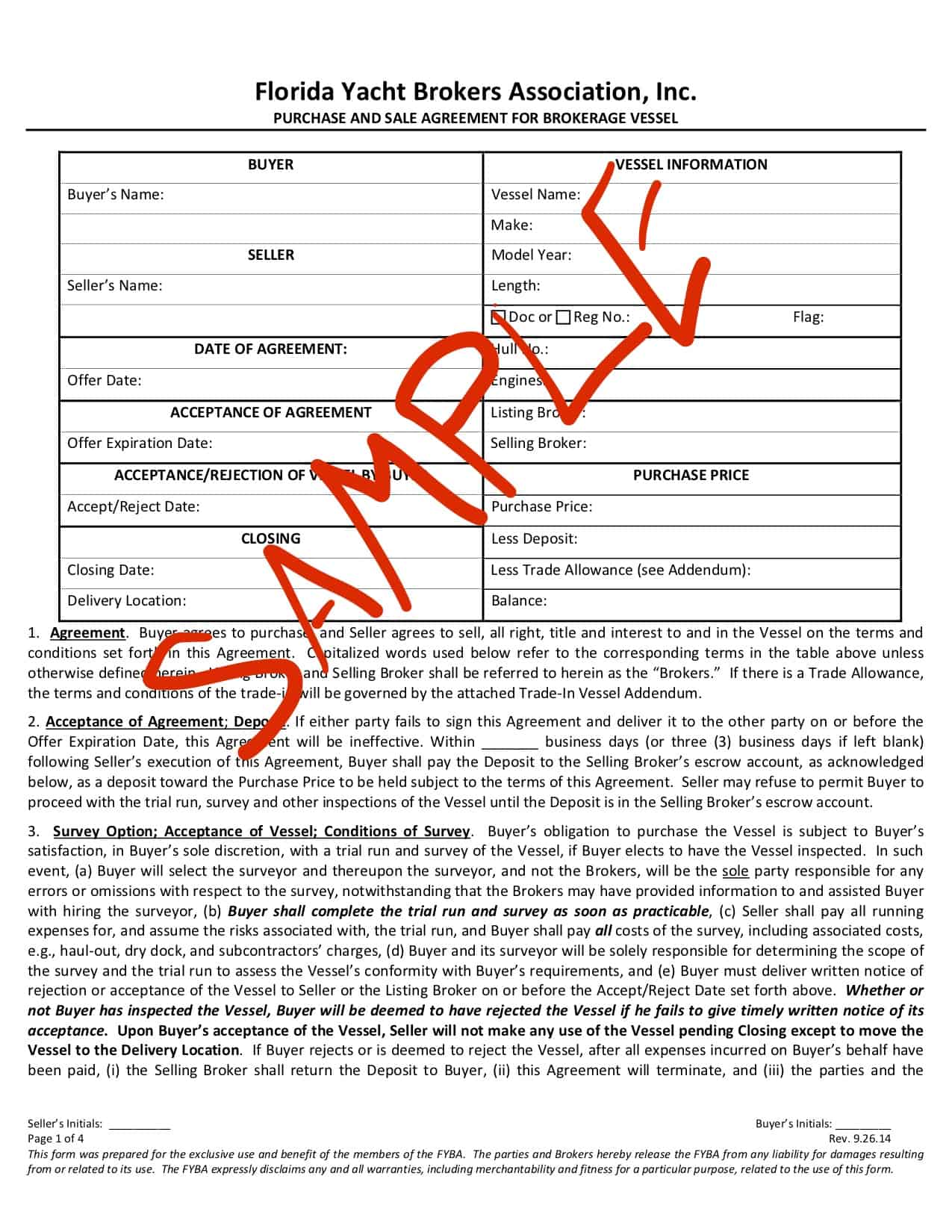

Whether you buy a brand new catamaran or a used catamaran directly from the owner, the best way to protect both parties is to put the terms of the sale in writing. This eliminates problems that could later turn a seemingly simple deal into a nightmare. A legal document will clearly list the intentions of the buyer and seller by outlining the obligations of each party, as well as spelling out the obligations and time frame for each party involved.

Basic Catamaran Purchase & Sale Contract Terms

Sales agreements or contracts should include the following information:

- Names and addresses of buyer and seller

- Complete description of boat and engine including make, model, year, as well as hull-identification number (HIN) and engine serial number(s). A complete equipment list is a must. If there’s a trailer, include its serial number, as well.

- The purchase price including a description of any deposits paid by buyer and how the balance will be paid (for example, wire transfer, certified check, etc.)

- A firm delivery date describing when and where the boat will be delivered and the deal finalized.

- The boat’s condition at the time of delivery, including a complete list of the accessories and items that convey with the boat.

- A full description of any warranty from the dealer or manufacturer. When boats are sold in “as is” condition, recourse may be impossible if problems arise

- Buyer’s contingencies: Spell out that the sale hinges on a satisfactory survey and sea trial and the ability to obtain acceptable financing and marine insurance

- A statement that the boat is free of all liens and encumbrances.

Boat Sales, Use & Property Taxes

Every state and county has different regulations and they are always subject to change. We use the state of Florida as an example here, but it is important to check with your own state offices to determine what taxes you might owe. However, there are usually three kinds of basic taxes, no matter what type of boat you buy.

1. Sales Tax

Sales taxes are imposed at the time of purchase or transfer. There are non-taxing states, such as Delaware or Rhode Island. In states like Florida, the state sales tax rate is usually 6 percent plus any applicable discretionary sales surtax. In Florida, the maximum tax of $18,000 applies. See Florida Revenue State and Use Tax for Boat Owners/Purchasers.

In some jurisdictions like Florida, there may be a “removal clause” in a state’s statutes. It requires the buyer to submit a removal affidavit: A non-resident buyer must certify the boat will be leaving the state within a certain amount of time. A buyer can also be required to submit proof of departure (fuel or dockage receipts) and registration in another jurisdiction. The process is relatively straightforward, but it is imperative the guidelines are followed. If a boat owner decides to move his or her boat from one of the five states without a general sales tax (Alaska, Delaware, Montana, New Hampshire, and Oregon) to another state, when the vessel is registered in the new state, it will trigger the sales tax due.

An offshore closing is an option for buyers who want to avoid sales tax, especially when dealing with boats of considerable value or for owners who plan to travel constantly or register the boat in a foreign location. Read more about tax and legal considerations for buying a yacht outside the US.

Many state tax agencies aggressively look for boaters who don’t pay sales tax and may try to collect the equivalent use tax on boats if they have been there from 30 to 180 days. California and Maryland among others will search ownership records and even inspect marinas for out-of-state boats.

Some states are more boater-friendly than others for sales taxes:

- Florida caps the amount of boat sales tax at $18,000.

- Rhode Island has no sales tax on boats.

- North Carolina’s boat sales tax is 3% and capped at $1,500.

- Connecticut sales tax is 2.99% on boats.

- New Jersey is 3.5% and capped it at $20,000.

- Alabama is 2% but has no cap.

- New York sales tax applies to only the first $230,000 of a boat’s purchase price.

- Maryland caps tax at $15,000 on boats.

- Virginia the boat sales tax is 2% and capped at $2,000.

2. Use Tax

Use tax is imposed on boats not taxed at the time of purchase at the same rate as a state’s sales tax.. Use tax may be paid at the time of registration in a state other than where a boat was purchased, or it can be triggered by the use or storage of a boat for a certain amount of time in a given county. Each state has its own rules as to how long a boat registered elsewhere can be within its jurisdiction before triggering use tax liability.

3. Property Tax

Some states like Virginia have an annual property tax on boats which can be more expensive than sales and use taxes over an extended period of time. Property tax can be a complex battle for those boats that spend time in multiple jurisdictions where it is not tax-paid.

This elementary overview of sales and use taxes on boats does not present all possible presumptions, exceptions, clauses, and penalties. It is simply impractical to cover it all here. Consult with your yacht broker, CPA, and / or attorney.

Importation & Federal Duty

Once a value has been placed on a vessel, the customs agent can calculate the exact cost of duty that will be due and provide the owner of the boat with an invoice and instructions on how to make payment to complete the importation of the vessel.

If your boat has never been imported into the US, you will have to do the importation and pay the Federal Duty. Duty is calculated at 1.5% x the value of the yacht and other miscellaneous fees. Once the Duty has been paid, you will receive US “Entry Summary” or CBP Form 7501, which shows Duty has been paid on the vessel and allows the vessel to cruise freely in US Waters as a Duty Paid vessel.

Here are two great articles:

Detailed Yacht Buying Process

Click to see more detailed information about how to buy a boat, documentation, finance, taxes etc.