What is the Section 179 Deduction?

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. That means that if you buy a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. That means that if you buy a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the “SUV Tax Loophole” or the “Hummer Deduction” because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUVs and Hummers).

Today, Section 179 is one of the few incentives included in any of the recent Stimulus Bills that actually helps small businesses. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much-needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits.

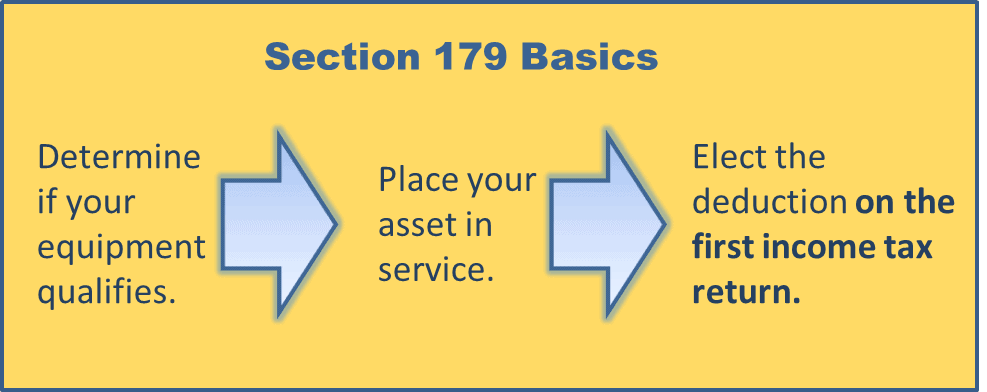

Section 179 Tax Deduction Works Like This

Before Section 179, when your business bought equipment items, it typically wrote them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write-off the entire amount, they might add more equipment this year instead of waiting over the next few years. That’s the whole purpose behind Section 179 – to motivate the American economy (and your small business) to move in a positive direction.

Limits of Section 179 Tax deduction

Each year the amount of deduction changes as well as the equipment spending cap that, if exceeded, reduces the Section 179 expense, dollar-for-dollar. There is bonus depreciation rules that apply if the spending cap is reached so while the tax deductions are straightforward, there is a lot to remember.

After passage of the ‘American Taxpayer Relief Act’, large businesses that exceed the spending cap in capital expenditure can take a Bonus Depreciation of 50% on the amount that exceeds the above limit. Nice.

Who Qualifies for Section 179?

All businesses that purchase, finance, and/or lease less than the designated limit (example, in 2022, the limit was $1,080,000 with a spending cap of $2,700,000 before any reductions in the deduction) are eligible for the Section 179 deduction. If a business is unprofitable having no taxable income to use the deduction against, that business can elect to use 50% Bonus Depreciation and carry-forward to a year when the business is profitable.

Most tangible goods qualify for the Section 179 Deduction. For basic guidelines on what property is covered under the Section 179 tax code, please refer to this list of qualifying equipment. Note that limits and spending caps change annually so be sure you know the rules and calculations for the year you plan to purchase/finance AND place your yacht in service.

What’s The Difference BeTween Section 179 & Bonus Depreciation?

The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation covers new equipment only. Bonus Depreciation is useful to very large businesses that exceed the Section 179 spending cap and those that face a net loss in the year of qualifying equipment purchases as it enables them to carry-forward the loss to use against profits in future years.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation – unless the business has no taxable profit in the year of qualifying equipment purchase.

Section 179’s “More Than 50% Business-Use” Request

The equipment must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the equipment by the percentage of business-use to arrive at the monetary amount eligible for Section 179.